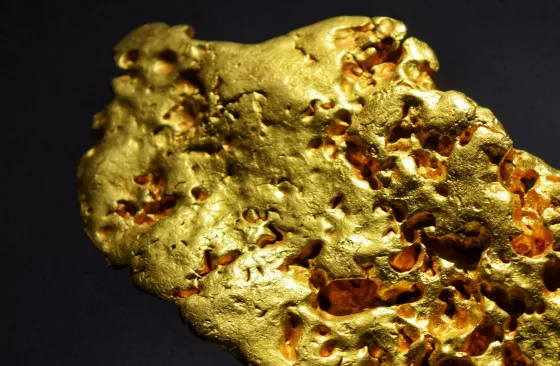

The allure of rare gemstones has captivated humans for centuries, but nothing sparks more fascination than discovering that some stones command higher prices than gold. While gold is renowned for its stability and value worldwide, certain gemstones consistently outperform it in the market. In this article, you’ll learn why some gemstones are pricier than gold, focusing on the crucial roles of supply, demand, and scarcity. We’ll highlight gemstone pricing factors, the dynamics of gemstone supply and demand, and why market inefficiency often boosts gem values.

Understanding Gemstone Value

Understanding why some gemstones command astronomical prices while others remain affordable starts with recognising the key factors that drive gemstone value. Let’s explore each essential element:

1. Rarity: Nature’s Scarcity Premium

Rarity is arguably the most significant value driver for gemstones. Unlike gold, which can be found in various locations and quantities, some gemstones are incredibly scarce due to:

- Geographic limitation: Precious stones like tanzanite (found only near Mt. Kilimanjaro) or alexandrite (discovered in select Russian and Brazilian mines) are unique to small regions, limiting global supply.

- Formation conditions: Complex geological processes mean that gem-quality stones form under rare and specific circumstances, thereby increasing their scarcity.

- Depletion of mines: Once a deposit is exhausted, the supply chain is permanently disrupted, further driving up gemstone prices.

2. Quality: The Four Cs of Gemstone Value

The quality of a gem is determined by the universally recognised Four Cs:

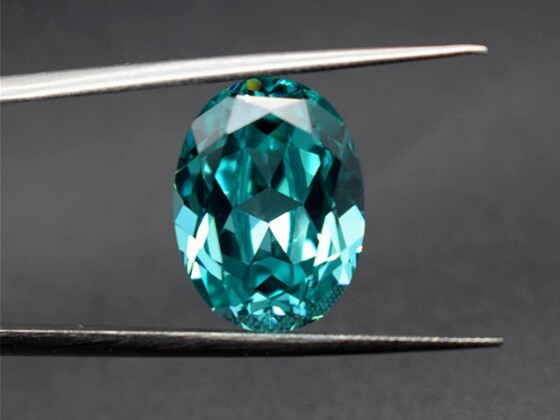

- Cut: A masterful cut brings out a gemstone’s brilliance, fire, and optical performance. Poor or imprecise cutting can significantly reduce the visual appeal and value of a stone, regardless of its innate qualities.

- Colour: For most gems, richer, more saturated hues attract higher prices. For example, a vividly blue sapphire or intensely red ruby commands a bigger premium.

- Clarity: Fewer visible inclusions (internal flaws) enhance a gemstone’s transparency, rarity, and overall worth. However, in some gemstones, such as emerald, minor inclusions are tolerated.

- Carat weight: Larger stones are exponentially rarer and significantly more valuable per carat. For example, a one-carat flawless diamond may be worth less per carat than a flawless ten-carat diamond due to rarity at scale.

3. Market Demand: The Economic Multiplier

Market demand is a dynamic factor that can cause prices to surge overnight. Several elements drive consumer, collector, and investor interest:

- Trends and fashion: When a gemstone—like padparadscha sapphire or paraiba tourmaline—becomes the “gem of the moment,” demand skyrockets.

- Cultural significance: Certain gems have an enduring appeal in specific cultures, resulting in perpetual demand (e.g., jadeite in China).

- Investment value: As alternative investments, rare gemstones attract collectors and speculators, particularly during times of economic uncertainty.

4. Origin: Provenance and Prestige

A gemstone’s origin, meaning the geographical region and mine from which it comes, adds significant prestige and often, price. For example:

- Sapphires from Kashmir or rubies from Burma (Myanmar) are renowned for their exceptional quality and now-limited supply, resulting in substantial price premiums.

- Emeralds from Colombia and demantoid garnets from Russia also command attention due to historical lore and unique characteristics associated with their region.

Provenance not only influences beauty and rarity but also heritage and cachet in the luxury market.

5. Certification: Trust and Transparency

Certification is the hallmark of authenticity and value in the gemstone trade. Reputable labs like the Gemological Institute of America (GIA) or American Gem Trade Association (AGTA) issue detailed grading reports and authenticity certificates. These documents:

- Validate gem type/species

- Grade quality factors (the Four Cs)

- Disclose treatments (e.g., heat, clarity enhancement)

- Indicate origin (when determinable)

For buyers, certification provides peace of mind and facilitates a smoother resale process. For sellers, it commands higher prices and trust.

How These Value Factors Interact

It’s essential to note that these gemstone value factors don’t operate in isolation; they are interrelated. For example, a rare blue diamond (rarity), with exceptional clarity and colour (quality), found in a legendary South African mine (origin), carrying a GIA certificate (certification), and suddenly trending due to a celebrity auction (demand), could sell for many times its “intrinsic” value.

This complex interplay makes the gemstone market exciting, sometimes unpredictable, and always rewarding for those who understand it.

Supply and Demand Basics

The Law of Supply and Demand in the Gem Market

The economics of the gemstone market mirrors traditional commodity markets: prices reflect the balance between supply and demand. If demand for a particular gem exceeds available supply, prices rise. Conversely, if supply swamps demand, prices tend to fall. However, in the gemstone trade, supply can often be erratic, with sporadic discoveries or sudden mine closures making the market far more volatile than the gold market.

Scarcity: The Rarity Premium

Scarcity sets gemstones apart from most other assets. Mines may be depleted, geopolitical instability can halt extraction, and some gems only exist in tiny pockets of the earth. For example:

- Alexandrite is famous for its colour-changing properties and extreme scarcity.

- Tanzanite is mined exclusively in a small area of Tanzania, adding a dramatic rarity premium.

- Paraíba tourmaline, notable for its vivid fluorescence, exemplifies how supply-driven scarcity can skyrocket prices.

Market Inefficiency and Subjective Pricing

Why Gemstone Prices Vary More Than Gold

Unlike gold, which trades as a regulated commodity with transparent pricing, gemstones occupy a subjective and inefficient market. Factors such as individual taste, minute differences in cut or colour, and personal negotiation can cause wide price ranges for similar stones. Even expert appraisers may disagree on value. This subjectivity often translates into higher profit margins and fluctuating prices, especially among high-end and rare gems.

Notable Examples of Gemstones Pricier Than Gold

Supply Chain and Global Dynamics

Sourcing: From Mines to Market

The journey from mine to consumer for gemstones is long and fraught with interruptions. Geopolitical factors, mining conditions, and export policies can create tight bottlenecks in the gem supply chain. Global events, such as pandemics or conflicts, further constrain gem supply, leading to sudden price spikes. Furthermore, the “ethical sourcing” trend is shaping new demand patterns, and buyers scrutinise gems more closely for responsible origins.

Demand Shocks and Trend Influence

Trends and pop culture have a direct impact on gem prices. When a celebrity wears a rare jewel or a gemstone makes an appearance in high fashion, demand can surge almost overnight. Such demand shocks push prices far above gold, especially for “trending gemstones” or stones new to the spotlight. Social media and influencer marketing now play pivotal roles in making certain gems highly sought after.

Protecting Buyers and Navigating the Market

Spotting Value and Avoiding Overpriced Stones

Steering through the gemstone market requires vigilance. Here are helpful tips to maximise value and reduce risk:

- Seek third-party certification (GIA, AGTA).

- Use reputable dealers and ask for detailed provenance.

- Compare prices using industry price guides, recognising that natural stones have inherent price variability.

- Be cautious with trends—today’s hot gem can cool off tomorrow.

- Remember, authenticity checks and genuine gemstone price guides protect your investment.

Conclusion

Supply, demand, and scarcity combine can make it so that some gemstones are pricier than gold. Rarity, quality, provenance, and ever-shifting global market dynamics mean gemstone values can soar beyond traditional benchmarks. Whether you’re a collector, investor, or simply an admirer, understanding these key gemstone pricing factors allows you to make informed, strategic decisions in a world where beauty and value often defy gravity.

Frequently Asked Questions (FAQ’s)

Ethically sourced gemstones are increasingly valued by consumers and investors. Certification of ethical mining practices can raise a gemstone’s value and desirability, reflecting the growing trend toward responsible luxury.

Yes! Celebrity endorsements and fashion trends can cause demand shocks, making certain gemstones highly sought after and rapidly increasing their market prices, sometimes even above gold.

Always seek independent certification, verify a gem’s provenance, compare prices using trusted price guides, and buy from reputable dealers. Understanding the factors behind gemstone pricing will help you identify fair value and avoid overpriced stones.

Gems like alexandrite, jadeite, red beryl, and paraiba tourmaline often command prices higher than gold due to their rarity and desirability. These “most expensive gemstones” can be hundreds or thousands of times costlier per carat than gold.

Ready to Start Your Gemstone Journey?

Don’t wait to discover the world of gemstones! Explore these essential reads right away.

Fascinated by this article and want to deepen your gemstone expertise? Dive into our comprehensive Gemstone Encyclopedia. Here, you’ll discover detailed information about hundreds of precious and semi-precious stones, including their properties and values.

For those interested in the rich cultural significance and fascinating stories behind these treasures, our History section offers captivating insights into how gemstones have shaped civilisations. Or perhaps you’d like to learn more about birthstones?

And if you’re considering gemstones as more than just beautiful adornments, visit our Precious Metal Investing guide. Here you will learn how these natural wonders can become valuable additions to your investment portfolio.