How U.S. Policy Is Reshaping the Global Market for Precious Minerals

On April 2, 2025, President Donald Trump announced sweeping tariffs designed to rebalance trade and boost domestic manufacturing. These tariffs include a baseline 10% duty on most imports, with significantly higher rates for specific countries: China faces 34%, Thailand 37%, India 26–27%, and the European Union 20%. Although aimed broadly, these tariffs severely affect the global gemstone market due to the intertwined international supply chains that characterise the industry. Understanding how Trump tariffs, the global gemstone market, and U.S. trade policy intersect is critical to grasp this complex economic landscape.

Background: The Global Gemstone Market and Supply Chains

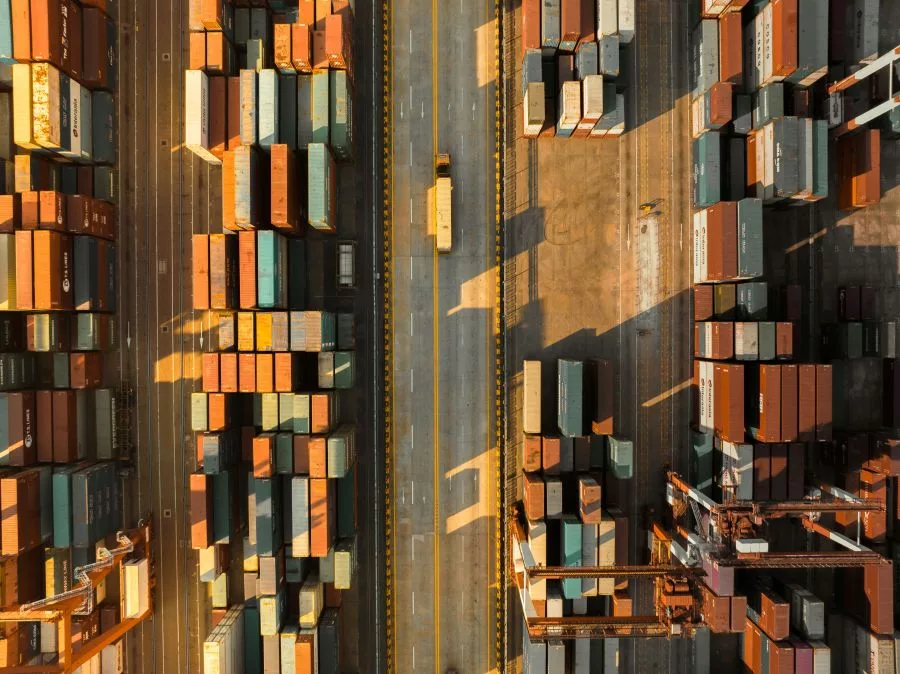

The global gemstone supply chain illustrates the intricate journey that precious minerals undergo from extraction to final sale. It starts in mining regions, where rough gemstones, such as diamonds, sapphires, rubies, and emeralds, are carefully extracted from the earth. Key extraction sites span African countries like Botswana, South Africa, Namibia, and Tanzania, which collectively contribute a significant portion of the world’s raw gemstone output.

Role of Countries in Gemstone Processing and Trade

After extraction, these raw stones enter the gemstone processing phase, which often takes place in specialised hubs far from mining sites. Countries including India, Thailand, and China serve as global centres for cutting, polishing, grading, and certifying gemstones. India stands out as the world leader in diamond cutting and polishing, employing millions of skilled artisans, particularly in Surat and Mumbai. Thailand excels in colored gemstones, such as rubies and sapphires, with Bangkok acting as a central marketplace and export hub. China not only processes gemstones but also rapidly grows as a major consumer market, adding significant demand within the precious minerals trade.

How Globalisation Creates Complex Interdependencies

Following processing, precious minerals move through extensive distribution networks, reaching consumer markets worldwide. The European Union and the United States represent the largest endpoints of this supply chain. The U.S. alone drives roughly 40% of global demand for diamond jewellery, making it a crucial market for exporters and retailers.

Globalisation has forged deep and complex interdependencies across mining, processing, and distribution stages. Each step relies heavily on cross-border cooperation and efficient logistics, including shipping, customs clearance, and regulatory compliance. Disruptions at any point can cause ripple effects, increasing costs and destabilising markets globally.

Overview of Trump’s 2025 Tariffs

In April 2025, President Donald Trump announced a significant new tariff package known as the Trump 2025 tariffs. These tariffs aim to address longstanding trade imbalances between the U.S. and several major trading partners. While also promoting domestic manufacturing growth. The policy sets a baseline tariff of 10% on most imports into the United States but imposes significantly higher rates on targeted countries central to the global precious minerals trade, particularly affecting tariffs on the gemstone trade.

Key tariff rates under this policy include:

- 34% tariff on imports from China: China, a major processor and exporter of cut and polished gemstones, faces a steep tariff aimed at reducing trade deficits and promoting more U.S. production.

- 37% tariff on Thailand: As a vital global hub for colored gemstone processing and trading, especially rubies and sapphires, Thailand’s exports bear the highest targeted rate, impacting both supply and prices.

- 26% tariff on India: India, the world’s largest diamond cutting and polishing centre and a critical player in jewellery exports, sees a 26% tariff that threatens its $30+ billion gemstone and jewellery trade with the U.S.

- 20% tariff on the European Union: This rate targets goods from the EU, including luxury gemstone products and jewellery.

The goals of these tariffs focus primarily on reducing the U.S. trade deficit by making imports more expensive and encouraging businesses to shift towards domestic sourcing and manufacturing. By imposing these trade wars and gemstones-related tariffs, the Trump administration seeks to revitalise American industries and create jobs domestically, particularly in manufacturing sectors connected to luxury goods and raw materials.

Goals of the Tariffs: Reducing Trade Imbalances and Promoting Domestic Manufacturing

The Trump 2025 tariffs aim to reduce the U.S. trade deficit and stimulate domestic manufacturing by increasing the cost of imported goods. The administration intends these tariffs to encourage companies to reshore operations and reduce reliance on foreign suppliers. In particular, the policy targets sectors integral to the precious minerals trade and related manufacturing industries. By implementing these tariffs, the government hopes to strengthen U.S. production capabilities and create more jobs domestically.

Impact on the Gemstone Industry Amid Trade Wars

These tariffs directly affect the tariffs on gemstone trade, introducing higher costs at multiple points along the supply chain. They have triggered concerns throughout the industry about disrupting the finely balanced global network connecting mining, processing, and retail. The decision highlights the broader context of trade wars and gemstones, where geopolitical tensions shape market dynamics and economic relationships. While designed to boost domestic interests, the tariffs risk causing ripple effects across international suppliers and retailers.

Impact of Tariffs on the Global Gemstone Market

The introduction of the Trump 2025 tariffs has caused significant disruption to the gemstone supply chain. And increasing costs and creating inefficiencies at multiple points along international trade routes. Raw gemstones mined in countries such as Botswana, South Africa, and Tanzania commonly travel to processing centres in India, Thailand, or China before reaching retail markets, including the U.S. With steep tariffs, each transfer stage now faces higher import costs. These additional expenses cascade through the supply chain, making operations more costly and complicating logistics. For example, the Antwerp diamond trading hub reported shipment volumes dropping to a fraction of normal levels following tariff impositions. This indicates a slowdown in supply chain fluidity and efficiency.

Need for Companies to Reevaluate Sourcing and Manufacturing Strategies

Faced with these rising costs and uncertainties, companies in the gemstone industry must urgently reassess their sourcing and manufacturing strategies. Many jewellery manufacturers and gemstone dealers are reconsidering their supplier relationships, seeking alternatives to countries with the highest tariffs or stockpiling inventory to mitigate the impact of upcoming tariffs. The interwoven nature of mining, cutting, polishing, and distribution means that changing one supplier or production site can necessitate significant adjustments across the entire chain. Industry leaders recognise that this reconfiguration demands both strategic flexibility and keen market insight. This is to maintain profit margins and meet customer demand without passing untenable costs onto consumers.

Potential for Increased Domestic Investment — Challenges and Timeline

The Trump administration suggests that tariffs will encourage domestic investment in gemstone processing and manufacturing to reduce foreign dependencies. However, building such domestic capacity faces considerable challenges. The U.S. currently lacks a significant diamond mining industry, and domestic processing infrastructure is limited. Developing high-skilled cutting and polishing centres requires time, large capital investment, and workforce training. Experts warn that any potential surge in U.S.-based gemstone manufacturing will likely take years to materialise. And this may not fully replace the efficient, established international networks already in place. Meanwhile, companies face ongoing tariff pressures, amplifying short- to medium-term disruption without guaranteed quick benefits from reshoring.

Trade War Economic Effects on the Gemstone Market

The overall trade war economic effects extend beyond mere price increases. The uncertainty and unpredictability introduced by tariffs discourage investment and slow order cycles. U.S. jewellers face higher input costs and may pass these on to consumers or endure lower profits. Smaller businesses risk layoffs or closures due to reduced competitiveness. Internationally, retaliatory measures and supply chain adjustments may fragment the global gemstone market. This is diminishing the economies of scale that have supported growth for decades. Consequently, the industry confronts a period of volatility and restructuring driven largely by the new tariffs and ongoing geopolitical tensions.

Trade Retaliation and Broader Economic Effects

In response to the Trump 2025 tariffs, several key players in the global gemstone market have announced retaliatory actions. China, facing a 34% tariff on its gemstone exports to the U.S., has already imposed reciprocal tariffs of the same rate on American goods. Intensifying the trade standoff. India, heavily impacted by a 26–27% U.S. tariff on its $ 30 billion+ gemstone and jewellery exports, is actively negotiating with the U.S. government in an attempt to reduce or eliminate these tariffs to protect its vital industry.

The European Union, confronted with a 20% tariff from the U.S., is evaluating a broad range of countermeasures. Including the possibility of imposing retaliatory tariffs around 25% on certain American products. Potentially including luxury items such as diamonds and related goods. Diplomatic talks have so far failed to reach a lasting agreement, with EU officials warning that higher tariffs could “practically prevent” transatlantic trade.

Possible Escalation of Trade Disputes and Effects on Gemstone Trade Stability

This tit-for-tat tariff escalation risks deteriorating into a prolonged trade war, which threatens the stability of the global gemstone market. As tariffs rise and retaliations multiply, established supply chains face increasing unpredictability. The layered tariffs on multiple processing and trading hubs disrupt the smooth flow of gemstones and jewellery goods, forcing companies to navigate a complex tariff landscape that compounds costs at every stage.

Such instability promotes uncertainty in purchasing decisions and pricing, discouraging investment in new projects or expansions. The gemstone trade depends heavily on stable, long-term contracts and predictable logistics; disruptions heighten the risk of delayed shipments, increased prices, and shrinking margins. This environment could fragment previously integrated trade routes and partnerships, reducing the overall efficiency and scale of the industry.

Uncertainty Effects on Investment and Small Businesses Like Jewellers

The growing economic uncertainty resulting from ongoing trade tensions extends to all market participants, from multinational miners and processors to small independent jewellers. Investors tend to adopt a cautious posture in uncertain environments, delaying capital expenditure or expansion plans. This investment slowdown curtails innovation and expansion efforts necessary to respond to evolving market demands.

Small and mid-sized jewellers, often operating with tight profit margins, find themselves squeezed by rising input costs and fluctuating supply. Many struggle to absorb the tariffs without passing costs to consumers, which risks reducing demand. Industry reports highlight cases of jewellers facing loss-making orders when tariffs complicate pricing, undermining the viability of smaller firms that lack the financial buffer of larger corporations.

Long-Term Outlook for the Gemstone Industry

The future of the gemstone industry inevitably includes significant market restructuring triggered by the recent tariffs and ongoing trade tensions. As traditional supply chains face disruption and growing costs, companies are reevaluating their international partnerships and exploring new alliances. Businesses are likely to shift sourcing and processing activities to countries with more favourable trade terms or to emerging markets that offer cost advantages and reduced tariff exposure. This realignment may alter well-established trade routes, embedding greater regional diversification and resilience across the global supply chain.

Opportunities for Diversification of Export Markets

In addition to restructuring sourcing and processing networks, gemstone businesses are pursuing diversification of export markets to reduce risks associated with concentrated demand. While the United States remains the largest consumer, rising tariffs have encouraged exporters to intensify efforts to access growing markets in the European Union, the Middle East, East Asia, and emerging economies.

This strategic diversification supports sales growth and hedges against the uncertainties created by post-tariff market shifts, allowing companies to balance portfolios and pursue new consumer demographics. Exporters also increasingly tailor products to fit regional preferences and price sensitivities, creating more nuanced market penetration strategies.

Conclusion

The U.S. tariffs introduced under the Trump administration have had a profound impact on the global gemstone market, disrupting well-established supply chains and significantly increasing costs across mining, processing, and distribution stages. These tariffs challenge businesses around the world to rethink their sourcing, manufacturing, and pricing strategies amid growing gemstone supply chain disruption and trade war economic effects. Companies and governments alike must adopt strategic adaptation measures to navigate this complex environment, seeking new partnerships, diversifying markets, and investing cautiously in domestic capabilities.

As trade policies and geopolitical tensions continue to evolve, it is essential for all stakeholders to monitor changes and respond proactively to shifting conditions closely. Vigorous attention to regulatory developments will help businesses mitigate risks and identify opportunities within the dynamic landscape shaped by Trump tariffs and ongoing trade wars and gemstones. By embracing flexibility and innovation, the global precious minerals industry can weather current challenges and position itself for resilient growth in the years ahead.

Frequently Asked Questions (FAQ)

The global gemstone market relies on a highly interconnected network where raw stones are mined in Africa or Myanmar, processed in India, Thailand, or China, and then distributed worldwide, especially to the U.S. This complex web means tariffs applied at multiple stages increase costs cumulatively. Causing gemstone supply chain disruption and inefficiencies that ripple across the entire industry.

Key players in the precious minerals trade include African nations (Botswana, South Africa, Namibia), India (global leader in cutting and polishing diamonds), Thailand (major hub for colored gemstones), China (processing and growing consumer market), and the European Union (important consumer and importer).

Companies are reevaluating sourcing and manufacturing strategies. By seeking alternative suppliers, diversifying markets, stockpiling inventory, and investing cautiously in reshoring where feasible. Strategic adaptation and flexibility are crucial for navigating evolving trade policies and maintaining competitiveness.

Closely following government announcements, trade negotiations, and market responses is critical. Proactive engagement and risk assessment enable businesses and governments in the global gemstone market. And need to anticipate shifts, comply with regulations, and find new growth opportunities amid continuing trade wars and gemstones tensions.

Ready to Start Your Gemstone Journey?

Don’t wait to discover the world of gemstones! Explore these essential reads right away.

Fascinated by this article and want to deepen your gemstone expertise? Dive into our comprehensive Gemstone Encyclopedia. Here, you’ll discover detailed information about hundreds of precious and semi-precious stones, including their properties and values.

For those interested in the rich cultural significance and fascinating stories behind these treasures, our History section offers captivating insights into how gemstones have shaped civilisations. Or perhaps you’d like to learn more about birthstones?

And if you’re considering gemstones as more than just beautiful adornments, visit our Precious Metal Investing guide. Here you will learn how these natural wonders can become valuable additions to your investment portfolio.