Is a Golden Nest Egg Right for You?

In today’s ever-changing economic landscape, a Gold IRA has become an increasingly popular option for investors seeking to protect and grow their retirement savings. With inflation rates fluctuating and market volatility causing concern, many are looking beyond traditional retirement accounts for stability and growth. But before you dive into this shiny opportunity, it’s important to weigh both the advantages and drawbacks. Let’s explore the pros and cons of this precious metals investment option in 2025 to help you decide if it’s the right fit for your financial future.

The Bright Side: Pros of a Gold IRA in 2025

First and foremost, one of the biggest draws of this investment vehicle is its reputation as a powerful hedge against inflation. Historically, gold has maintained or even increased its value during times when the purchasing power of paper currency declines. This makes it a valuable tool for preserving your wealth in uncertain economic climates.

Moreover, diversification is key to any successful investment strategy. By adding gold to your retirement portfolio, you can reduce overall risk and balance out the volatility that often comes with stocks and bonds. In fact, gold’s low correlation with traditional assets means it often performs well when other investments falter.

Another compelling advantage is wealth preservation. Gold has been treasured for centuries and is widely regarded as a generational asset. It can be passed down through families, offering stability across market cycles and geopolitical crises. In turbulent times, gold is often seen as a safe haven, providing peace of mind when other investments are shaky.

Additionally, these accounts come with the same tax benefits as traditional or Roth IRAs. This means your investments can grow tax-deferred or tax-free, depending on the account type, which can significantly boost your retirement savings over time.

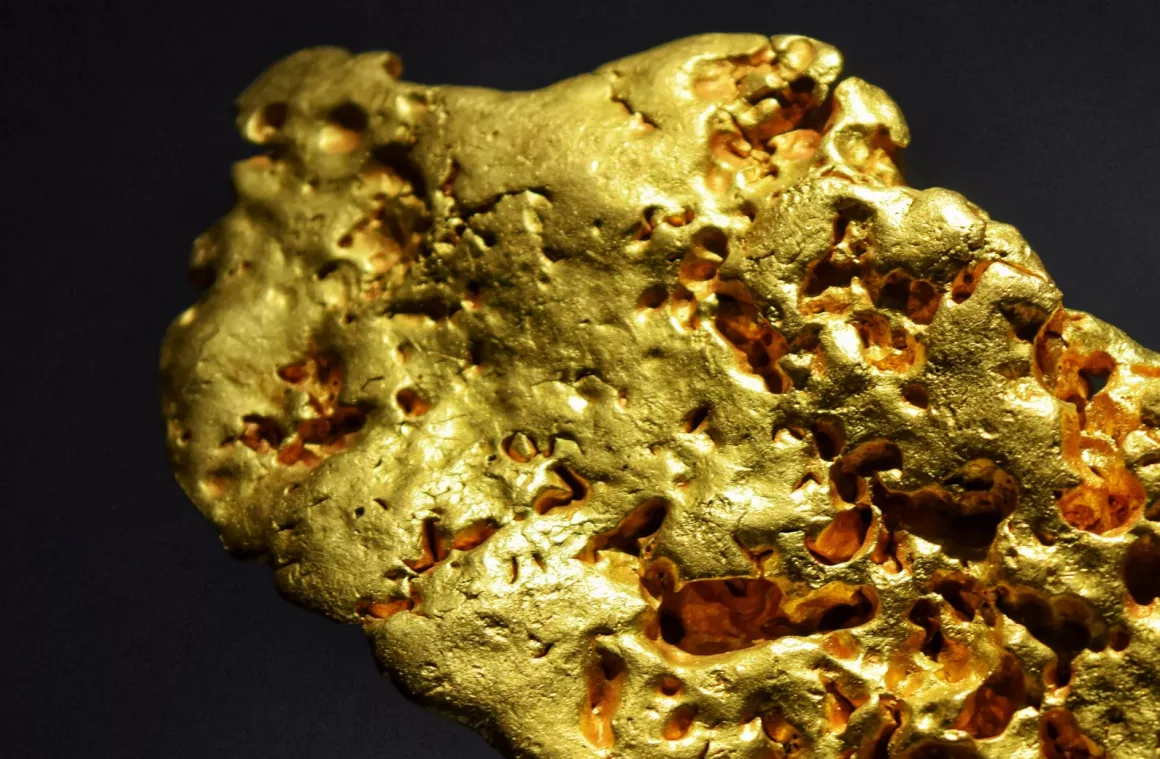

Finally, owning physical gold through a Gold IRA means you hold a tangible asset, not just a paper claim. For many investors, this physical ownership adds an extra layer of confidence and security.

The Other Side: Cons of a Gold IRA in 2025

Despite its many benefits, this type of retirement account isn’t without its challenges. One of the most notable drawbacks is the higher fees associated with these accounts. Setting up such a Gold IRA often involves initial setup fees, annual custodial fees, and storage fees for the precious metals. These costs can add up and eat into your overall returns.

Furthermore, gold does not generate passive income. Unlike stocks that pay dividends or bonds that pay interest, your returns from gold depend solely on price appreciation. This means your investment growth might be slower or less predictable.

Liquidity can also be a concern. Selling physical gold is generally more complex and time-consuming than liquidating stocks or bonds. This can pose challenges, especially when you need to take required minimum distributions (RMDs) or access funds quickly.

Additionally, setting up and maintaining this type of account requires working with specialised custodians and adhering to strict IRS regulations. This complexity may deter some investors who prefer a simpler retirement planning process.

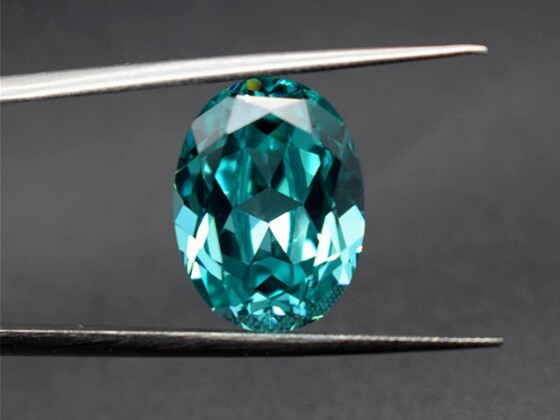

It’s also important to note that these accounts are limited to certain IRS-approved metals and products. This restriction limits diversification within the account itself, which may not suit every investor’s strategy.

Lastly, there are tax and penalty risks to consider. Early withdrawals before age 59½ can trigger taxes and penalties, and failing to meet RMD requirements can result in substantial fines.

Key Tax Rules for Gold IRAs in 2025

To navigate these accounts successfully, it’s crucial to understand the tax rules. In 2025, the annual contribution limits for Gold IRAs, including those holding precious metals, are $7,000 for individuals under 50 and $8,000 for those 50 and older. Distributions from traditional accounts are taxed as ordinary income, while Roth accounts offer tax-free withdrawals if certain conditions are met. Required minimum distributions begin at age 73 for traditional accounts, but Roth accounts do not have RMDs during the original owner’s lifetime.

Conclusion: Is This Investment Right for You in 2025?

In conclusion, adding physical gold to your retirement portfolio through a Gold IRA offers valuable diversification, inflation protection, and the security of tangible assets. However, you must weigh these benefits against higher fees, the absence of passive income, and added complexity. If you accept these trade-offs and want to safeguard your retirement from economic uncertainties, this option could be the golden opportunity you’ve been seeking.

As with any investment decision, consulting a qualified financial advisor is highly recommended. They can help tailor a strategy that aligns with your long-term goals. And help with risk tolerance, ensuring your retirement nest egg truly shines.

Start building your precious metals portfolio today by exploring our comprehensive guide: How to Start Investing in Physical Gold and Silver. In this article, you’ll discover how to choose between coins and bars, find reputable dealers, select secure storage options, and apply practical tips designed for new investors. Use this guide as your launchpad into the world of gold and silver investing with confidence. Don’t forget to check out our other investing guides for even more expert insights.