The global gemstone trade is a significant economic and cultural sector with deep historical roots and strong contemporary relevance. This article explores which countries and regions are leaders in gemstone mining, cutting, trading, exporting, and importing. Industry stakeholders, investors, and enthusiasts will find this analysis valuable for understanding regional strengths and market dynamics.

The Global Gemstone Trade: An Overview

The global gemstone market continues to demonstrate robust growth, having been valued at approximately $36 billion in 2025. This marked a significant increase, driven by a healthy 5.7% year-over-year growth rate, reflecting rising consumer demand and evolving industry dynamics. Looking ahead, analysts project a compound annual growth rate (CAGR) of 6.6% through 2035, driven by multiple market forces shaping both supply and demand.

Market Composition:

Diamonds dominate the market, accounting for nearly 65% of the total market share. Their timeless appeal, rarity, and association with luxury and milestones such as engagements and anniversaries continue to fuel demand. Meanwhile, coloured gemstones, including rubies, sapphires, emeralds, and tourmalines, account for approximately 25% of the market. These stones are rising in popularity as consumers seek more unique and personalised jewellery options. Pearls, although representing a smaller portion of the market, remain a classic choice, particularly in high-end and bridal jewellery.

Key Growth Drivers of the Global Gemstone Trade:

Rising Global Wealth and Disposable Income

Economic growth in emerging markets, particularly in the Asia-Pacific region and parts of Africa and Latin America, has expanded the middle and upper classes, resulting in increased purchasing power. This broader wealth distribution enables more consumers to enter the gemstone market, both for fashion and investment purposes.

Shifting Fashion Trends Favoring Unique Colored Gemstones

The global appetite for colored gemstones is increasing rapidly. Modern consumers are gravitating towards distinctive, vibrant stones that allow for personal expression beyond traditional diamonds. Celebrity endorsements, social media influencers, and shifting bridal traditions are fueling this trend, adding momentum to the coloured gemstone sector.

Increasing Investment Demand in Gemstones as Stable Assets

Amidst global economic uncertainty and volatility in traditional markets, gemstones are gaining recognition as an alternative investment. Their inherent rarity, durability, and portability make diamonds and high-quality coloured stones attractive for wealth preservation. This trend is especially strong among high-net-worth individuals and investors from emerging economies.

Expansion of Ethical Sourcing and Certification Technologies

Consumer awareness about sustainable and ethical sourcing is growing worldwide. Buyers are increasingly demanding transparency in the origin and supply chain of gemstones to avoid conflict stones and environmental harm. In response, the industry has adopted rigorous certification standards and technologies such as blockchain to verify provenance and ensure compliance with global ethical frameworks.

Adoption of Synthetic and Lab-Grown Stones Gaining Traction

Advances in gemstone synthesis have made lab-grown diamonds and colored gems nearly indistinguishable from their natural counterparts, both visually and chemically. These options appeal particularly to younger buyers who prioritise environmental sustainability and affordability. As this segment expands, it is reshaping market dynamics and stimulating the emergence of new consumer segments.

Regional Market Shares and Dynamics

The Asia-Pacific region increasingly dominates global gemstone consumption, accounting for over 42% of total demand. Countries such as China, India, and Japan are key drivers behind this surge, fueled by rising affluence and a growing cultural appreciation for gemstones. North America and Europe remain critical markets with mature consumer bases that are evolving towards ethical and luxury segments. Meanwhile, Africa and Latin America continue to supply a significant volume of rough stones, although local processing remains a developmental challenge in certain areas.

Technological and Market Innovations

Beyond production and consumption, technological advances play a key role. Improved cutting techniques, innovative retail experiences (such as augmented reality try-ons), digital marketplaces, and blockchain-based certification contribute to market transparency and customer engagement, thereby bolstering further growth.

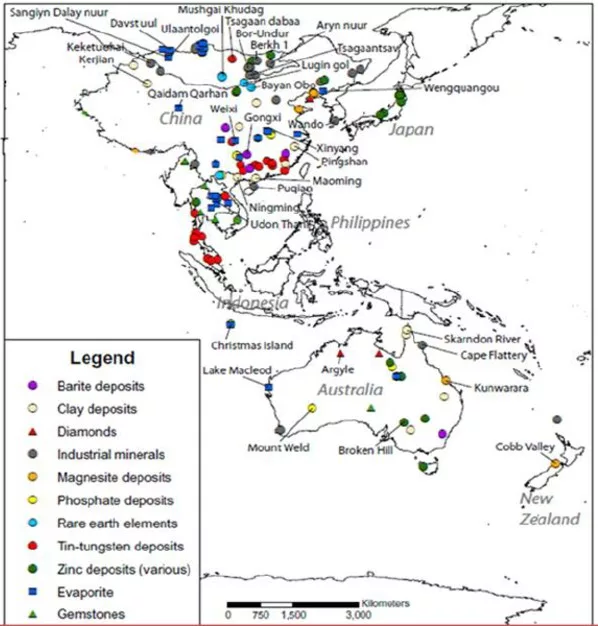

Leading Gemstone-Producing Regions

Africa

Africa remains a dominant force in the global gemstone trade, particularly in the production and supply of rough gemstones, including diamonds, rubies, sapphires, and emeralds. The continent’s vast and diverse mineral wealth positions countries such as Botswana, Angola, South Africa, Nigeria, and the Democratic Republic of the Congo (DRC) as key players in the global supply chain.

Botswana

Botswana is renowned worldwide for its extensive diamond mines and consistently ranks among the top diamond producers by value globally. The country’s stable political environment and strong partnerships with international companies have promoted sustainable mining practices and significant export volumes.

Angola

Angola is rapidly emerging as a significant supplier of diamonds and coloured stones, including rubies and sapphires, due to increased exploration and investment. Its gem deposits mainly occur in alluvial deposits along rivers and coastal areas.

South Africa

South Africa boasts a historic legacy as one of the earliest diamond-mining territories and continues to make substantial contributions to global markets. It also has notable sapphire deposits and emerging emerald mining activities.

Nigeria and the DR Congo

Nigeria and the DR Congo provide a significant quantity of colored gemstones, including high-quality rubies, sapphires, and emeralds. However, both nations face challenges linked to artisanal mining methods, governance, and regulatory enforcement.

Despite the abundance of rough gemstone production, a significant challenge for many African countries remains the limited local gemstone processing capacity. Most stones mined are exported in their rough form, which means that much of the high-value cutting, polishing, and jewellery manufacturing takes place abroad. This offshoring of value addition often occurs in established Asian hubs, reducing potential economic benefits and job creation within Africa itself. The continent’s gemstone industry is increasingly focusing on developing fair trade practices, improving supply chain transparency, and attracting investment into local gemstone cutting and polishing facilities to capture more value domestically.

Asia-Pacific

The Asia-Pacific region holds the largest share of the global gemstone demand, accounting for roughly 42% of total consumption. This region plays a vital role not only as a consumer market but also as a cutting, trading, and processing powerhouse. Its influence extends from mining through to retail, making it one of the most dynamic zones in the global gemstone market.

Key countries and hubs in the Asia-Pacific region include:

Myanmar (Burma)

Known worldwide for its exceptional rubies and sapphires, Myanmar’s Mogok Valley has been a historic source of some of the finest and rarest gemstones. Despite export restrictions and regulatory challenges affecting the supply, Myanmar remains a critical player in the production of coloured gemstones.

Thailand

Thailand, with cities like Bangkok and Chanthaburi, is recognised as a leading global hub for gemstone trading and cutting. Bangkok’s extensive gemstone markets and infrastructure attract merchants and cutters from around the world, while Chanthaburi is famous for its skilled artisans specialising in cutting colored stones. Thailand’s strategic position and business-friendly policies have fostered an ecosystem that controls a significant portion of the global rough-to-polished gemstone supply chain.

China

China dominates in jade production and is rapidly expanding its footprint in sapphires and other colored stones. Beyond mining, China’s booming middle class fuels growing domestic consumption, particularly in luxury gemstone jewellery. Additionally, Chinese companies are investing heavily in advanced processing technologies and gemstone certification systems to meet the increasing demand from consumers for authenticity and quality.

India

India, particularly the city of Jaipur, is renowned as a global centre for diamond cutting, polishing, and colored gemstone processing. It processes approximately 90% of the world’s diamonds by volume, combining highly skilled labour with cost advantages. Jaipur also serves as a central trading hub, hosting numerous gemstone fairs and exhibitions, which makes it an integral part of global supply chains. The country’s cultural affinity for gemstones, combined with an expanding luxury market and supportive government regulations, continues to reinforce its influential position.

Several factors drive the dominance of the Asia-Pacific region in the gemstone industry:

- Cultural significance: Gemstones have deep historical and cultural roots in Asia, often associated with wealth, spirituality, and status. This heritage maintains strong consumer demand.

- Skilled labour force: The region benefits from generations of expertise in cutting, polishing, trading, and craftsmanship, ensuring high-quality output.

- Rapid economic growth: Expanding middle and upper classes across Asia create sustained and rising demand for fine gems, both natural and synthetic.

- Strategic infrastructure: Well-established trading centres, supported by advanced logistics, trade finance, and regulatory frameworks, enable the efficient movement of gemstones across international borders.

Collectively, these factors make the Asia-Pacific not just a consumer base but a critical processing and trading hub that influences global gemstone market trends, pricing, and innovation.

Europe

Europe has long held a prestigious place in the global gemstone trade, with its roots deeply intertwined in the history of diamond cutting, trading, and luxury jewellery craftsmanship. Although the continent’s actual mining and gemstone production are limited, Europe’s strength lies primarily in processing, trading, design, and retail.

Belgium (Antwerp)

Often regarded as the “diamond capital of the world,” Antwerp is the most significant global hub for diamond trading and cutting. Roughly 80% of the world’s rough diamonds pass through Antwerp’s trading markets annually. The city’s diamond district is home to a network of dealers, cutters, polishers, and certification entities that set international standards for pricing and quality. Antwerp’s powerful commodity exchanges and secure logistics infrastructure have cemented its reputation in the global diamond supply chain.

Italy

Italy is synonymous with high-end luxury jewellery design and artisanal craftsmanship. Cities like Milan and Valenza are renowned for producing exquisite jewellery pieces that blend tradition with innovation. Italian jewellers often source stones from international markets, focusing their expertise on creative designs and manufacturing, thereby adding significant value to the global gemstone trade.

United Kingdom

The UK, centred around London’s Hatton Garden district, remains a pivotal player in jewellery retail, wholesale trading, and auction markets. The city is a nexus for luxury gemstone sales, often focusing on both natural and synthetic stones to cater to evolving consumer preferences.

Europe’s strong retail markets, a wealth of veteran artisans, and established certification bodies like the Antwerp World Diamond Centre (AWDC) and the Gemological Institute of Europe (GIE) continue to uphold its crucial role. Furthermore, European consumers’ growing interest in ethical sourcing and sustainability pushes the continent’s players to lead in transparency, responsible mining advocacy, and eco-friendly luxury innovations.

Latin America

Latin America boasts some of the world’s richest deposits of precious coloured gemstones, serving as vital exporters to the global luxury market. The region’s gemstone heritage combines abundant natural resources with growing recognition in the international trade market.

Colombia

Globally renowned for producing the world’s finest emeralds, Colombia remains unmatched in quality and quantity. Colombian emeralds are prized for their vibrant green hues and exceptional clarity. Mining centres such as Muzo, Chivor, and Coscuez have historically yielded some of the purest emeralds. Colombia’s emerald producers supply both rough and cut stones to major international jewellery markets, contributing substantially to the country’s economy.

Brazil

Brazil is a fertile source of a diverse array of colored gemstones, including tourmaline, aquamarine, topaz, and amethyst. The state of Minas Gerais is especially famous for its gemstone mines. Brazilian colored stones are widely used in fine jewellery around the world due to their distinctive colours and affordability. Brazil’s exporters maintain strong trade relationships with cutting and trading centres in Asia and Europe.

Other countries, such as Venezuela and Argentina, also contribute notable quantities of coloured stones, particularly in artisanal mining communities.

Despite their rich gemstone resources, many Latin American countries face challenges related to infrastructure, artisanal mining regulation, and modernising supply chains. Efforts toward certification of origin, adherence to ethical mining practices, and value addition through local cutting and polishing are advancing to capture a greater market share and economic benefits.

North America

North America plays an influential role across the entire gemstone value chain, from mining to consumption and ethical standards.

Canada

Emerging as a significant diamond producer, Canada is known for its high-quality, ethically mined diamonds from mines such as Ekati, Diavik, and Gahcho Kué in the Northwest Territories. Canadian diamonds are often marketed with a strong emphasis on conflict-free certification and environmental responsibility, appealing to conscientious global consumers.

United States

The USA stands as the largest gemstone importer and consumer in the world. American buyers drive substantial demand for both natural and synthetic gemstones through a vast market that includes high-end luxury to popular fashion segments. The U.S. jewellery industry is continuously evolving, with growing consumer focus on ethical sourcing, traceability, and sustainability. Initiatives promoting responsible supply chains, along with the adoption of technology in certification and e-commerce, significantly influence international market trends.

The U.S. is also a major centre for gemstone research, trade exhibitions (such as the Tucson Gem and Mineral Show), and jewellery design innovation.

Middle East

The Middle East has emerged as a significant force within the luxury jewellery and gemstone trade, with the United Arab Emirates (UAE), particularly Dubai, acting as a dynamic regional hub.

Dubai

With its strategic geographic location bridging Asia, Europe, and Africa, Dubai has developed into a bustling centre for gemstone trading, re-export, and a luxury retail destination. The city offers world-class infrastructure, free trade zones, and a favourable business environment that attracts international gemstone merchants, traders, and manufacturers. Dubai’s markets emphasise high-quality diamonds, emeralds, rubies, and sapphires, catering to an affluent clientele both regionally and globally.

The region’s cultural emphasis on gifting during weddings and festivals boosts high per capita gemstone consumption, especially for diamonds, emeralds, rubies, and other precious stones. This cultural tradition helps sustain steady demand irrespective of global economic cycles.

Top Exporters and Importers by Country

The global gemstone trade is significantly influenced by a group of leading exporters and importers that excel in various stages of the value chain, ranging from mining and processing to trading and retail. Key exporters include India, known primarily for its world-leading diamond and coloured gemstone cutting and polishing industries; China, a major producer and exporter of natural and synthetic gemstones; and countries such as Tanzania, Brazil, Russia, and South Africa, which are vital raw material suppliers with varying degrees of local processing. These exporters benefit from advances in skilled labour, investment in certification technologies, and growing domestic markets. Their geographic diversity ensures a steady global supply of both rough and polished stones, meeting evolving market demand.

On the importing side, the United States leads as the largest global consumer and importer of both natural and lab-grown gemstones, driving trends toward ethical sourcing and traceability. China imports large volumes to support its booming domestic market and reprocessing industries, while Thailand, Hong Kong, Switzerland, and the UAE serve as critical regional hubs for cutting, trading, certification, and re-exporting. The dominance of these countries is supported by sophisticated logistics, robust regulatory frameworks, and well-established business ecosystems, which together enable efficient, transparent, and secure gemstone trade flows worldwide. This dynamic network ensures continued growth and innovation in the global gemstone market.

Challenges and Opportunities in the Global Gemstone Trade

The global gemstone trade faces a complex mix of challenges that threaten the sustainability, ethics, and equitable growth of the industry, alongside emerging opportunities driven by innovation, consumer shifts, and technology.

Key Challenges

Sustainability Concerns:

Mining gemstones, particularly in resource-rich yet economically fragile regions, can result in substantial environmental degradation, including deforestation, soil erosion, and water pollution. Unsustainable mining practices have a significant impact on local ecosystems and communities, creating long-term ecological risks. The industry must strike a balance between economic benefits and environmental stewardship to ensure the sustainable future of gemstone resources.

Fair Trade and Ethical Sourcing:

Conflict gemstones, sometimes referred to as “blood gems”, have tainted the reputation of parts of the trade, particularly in conflict zones where mining revenues finance armed groups. Enforcing fair trade principles remains challenging in artisanal mining sectors with informal labour practices and weak regulatory oversight. Ensuring miners receive fair wages, operate in safe conditions, and respect human rights is crucial to responsible sourcing.

Illicit Gemstone Flows:

The smuggling and illegal export of rough gemstones undermine legitimate markets, reduce state revenues, and contribute to corruption and conflict. Illicit flows also sabotage consumer confidence and ethical sourcing initiatives. Tracking and intercepting these underground trade routes present ongoing enforcement and governance challenges for many producing countries.

Limited Local Value Addition in Resource-Rich Countries:

Many gemstone-producing nations, particularly in Africa and Latin America, export a majority of their gems in rough form. Due to insufficient local cutting, polishing, and jewellery manufacturing infrastructure, significant economic value is lost when higher-value stages of the supply chain are performed in foreign countries, often in Asia. This limits job creation, skills development, and overall economic diversification.

Emerging Opportunities

Enhancing Local Value Addition:

Investing in local processing facilities and training can transform raw gemstone wealth into higher-value exports. Countries that build cutting, polishing, and jewellery-making capacities can retain more economic benefits, reduce dependency on foreign hubs, and stimulate domestic industries. Initiatives encouraging technology transfer, vocational training, and partnerships between governments and private sectors support this value chain strengthening.

Growth of Lab-Grown and Synthetic Gemstones Market:

Increasing consumer interest in eco-friendly and ethically produced gemstones has fueled rapid growth in the lab-grown sector. These stones offer a visually and chemically identical alternative to natural gems, often with lower environmental and social impacts. The rise of synthetic diamonds, sapphires, rubies, and other lab-created gems appeals especially to younger, environmentally-conscious buyers seeking affordability and transparency. This market segment is poised for continued expansion, reshaping competitive dynamics in the gemstone trade.

Expansion of E-Commerce Platforms:

Digital marketplaces have revolutionised gemstone retail and wholesale trading by increasing accessibility and transparency. E-commerce enables consumers globally to compare prices, assess certifications, and buy directly from producers or trusted dealers. Online auctions, virtual try-on technologies, and augmented reality apps enhance customer engagement and reduce purchase barriers. These platforms democratise access to rare and precious gems, extending beyond traditional brick-and-mortar settings.

Advancements in Certification Technologies:

Technological innovations, particularly blockchain-based provenance tracking, are transforming gemstone certification. These systems provide tamper-proof and transparent records of a gemstone’s journey from mine to market, ensuring authenticity and ethical sourcing claims. Enhanced certification technologies increase buyer confidence, curb illicit trading, and facilitate compliance with international regulations. Industry-wide adoption of such tools promises to elevate standards and trustworthiness across the global gemstone value chain.

Conclusion

The global gemstone trade is a complex and vibrant ecosystem shaped by the diverse and interdependent roles of countries across Africa, Asia-Pacific, Europe, Latin America, North America, and the Middle East. Each region contributes uniquely across the value chain — from mining and processing to trading and final consumption — making the industry truly global and multifaceted.

In sum, the future of the global gemstone trade is poised for dynamic transformation. Success will depend on how well stakeholders across continents harmonise heritage, innovation, and responsibility to build a more transparent, equitable, and vibrant market. By embracing these trends, the industry can unlock new avenues of growth and deliver enduring value to miners, traders, consumers, and communities worldwide.

Frequently Asked Questions (FAQ)

India leads in the volume of gemstone exports, especially in processing and cutting.

Asia-Pacific holds the largest share of consumption and demand, followed by North America and Europe.

Key issues include illicit mining, lack of local processing infrastructure, and ensuring ethical and sustainable practices.

Ready to Start Your Gemstone Journey?

Don’t wait to discover the world of gemstones! Explore these essential reads right away.

Fascinated by this article and want to deepen your gemstone expertise? Dive into our comprehensive Gemstone Encyclopedia. Here, you’ll discover detailed information about hundreds of precious and semi-precious stones, including their properties and values.

For those interested in the rich cultural significance and fascinating stories behind these treasures, our History section offers captivating insights into how gemstones have shaped civilisations. Or perhaps you’d like to learn more about birthstones?

And if you’re considering gemstones as more than just beautiful adornments, visit our Precious Metal Investing guide. Here you will learn how these natural wonders can become valuable additions to your investment portfolio.

2 comments

A lot of thanks for all your valuable efforts on this web site. My niece takes pleasure in carrying out investigation and it’s obvious why. Many of us learn all regarding the compelling tactic you convey worthwhile things on your website and strongly encourage contribution from other individuals about this point plus my girl has been starting to learn a whole lot. Enjoy the rest of the year. You have been carrying out a glorious job.

Thank you so much for your kind words, it is much appreciated to know that people are reading and enjoying my posts!

Comments are closed.