The Rising Appeal of Gemstone Investments in 2025

Gemstone investments are gaining serious traction in 2025, attracting both seasoned collectors and new investors seeking alternative assets. With global demand for coloured gemstones surging and auction records being shattered, rare and high-quality stones are outperforming many traditional investments. This article explores why savvy investors are turning to gemstones, highlights the best gemstones to invest in for 2025, and provides expert insights into market trends, risks, and practical investment strategies.

Why Consider Gemstones as an Investment?

Portfolio Diversification and Tangible Value

Savvy investors increasingly recognise gemstone investments as a compelling way to diversify their portfolios. Unlike traditional investments such as stocks or real estate, gemstones offer tangible, portable value that is easy to store and transport. This makes them an attractive asset class for those seeking to diversify their investments across various types of holdings. For collectors and investors who value both financial security and personal enjoyment, gemstones provide a unique opportunity to combine aesthetic pleasure with wealth preservation.

Hedge Against Inflation and Market Volatility

In times of inflation and market uncertainty, gemstones often act as a reliable hedge. Their rarity and enduring demand help them retain value over time, even when other asset classes experience downturns. While stocks and bonds can fluctuate rapidly with economic cycles, high-quality gems such as rubies, sapphires, emeralds, spinel, and Paraíba tourmaline have historically demonstrated resilience and even appreciation during periods of instability. This makes gemstones particularly appealing to investors seeking stability in unpredictable markets.

Aesthetic Appeal and Cultural Significance

Beyond their financial benefits, gemstones captivate investors with their beauty and cultural significance. Purple gemstones like amethyst, tanzanite, and kunzite are prized not only for their durability and colour but also for their historical and spiritual associations. Similarly, pink gemstones such as rhodochrosite, pink topaz, rose quartz, and pink tourmaline are sought after for their gentle hues and emotional resonance. Collectors appreciate the opportunity to own and display these natural treasures, which can also serve as personal talismans or meaningful gifts.

Privacy and Portability

Gemstones offer a level of privacy that is difficult to achieve with other investments. They can be discreetly stored, transported, and even passed down through generations. This portability makes them especially valuable for investors who prioritise confidentiality and flexibility in managing their assets.

Transition to Market Leaders

Transitioning from theory to practice, let’s examine which gemstones are currently leading the market and why. Rubies, sapphires, emeralds, spinel, and Paraíba tourmaline are among the top choices for 2025, each offering unique advantages in terms of rarity, market demand, and growth potential. Understanding these market leaders helps investors make informed decisions and build a resilient, diversified gemstone portfolio.

Top Gemstones to Invest in for 2025

Investors are actively seeking out gemstones that combine rarity, beauty, and strong market performance in 2025. Several stones stand out as top contenders, each offering unique advantages for collectors and long-term investors.

Rubies

Rubies remain a cornerstone of gemstone investments. Pigeon blood rubies from Burma, prized for their vivid red colour and limited supply, continue to see rising prices, especially for high-quality stones over one carat. These gems command premium values at auction and are considered one of the safest bets for long-term appreciation. Investors recognise their historical significance and enduring demand, which often outpaces supply.

Sapphires

Sapphires also dominate the investment landscape. Blue sapphires from Kashmir are celebrated for their exceptional colour and clarity, frequently fetching top prices in both retail and auction markets. Padparadscha sapphires, with their distinctive pink-orange hue, are increasingly sought after for their rarity and unique beauty. Additionally, sapphires from Montana and Australia, especially those in green and teal shades, are trending due to their vibrant colour and limited availability. Investors appreciate sapphires for their stability and consistent price growth.

Emeralds

Emeralds from Colombia are experiencing renewed popularity. Growing awareness of ethical mining practices and the stones’ rich green colour are attracting both collectors and socially conscious investors. High-quality, untreated emeralds are especially prized, as their rarity and beauty make them excellent candidates for long-term investment. The market for fine Colombian emeralds remains robust, with strong demand from international buyers.

Spinel

Spinel is emerging as a rising star in the gemstone market. Neon-pink Mahenge spinel from Tanzania and cobalt-blue spinel from Vietnam are capturing attention for their vibrant, untreated colours and excellent growth potential. Collectors value spinel for its rarity and the increasing difficulty of sourcing top-quality stones, which supports steady price appreciation. Spinel’s unique hues and limited supply make it a compelling choice for investors seeking to diversify their portfolios.

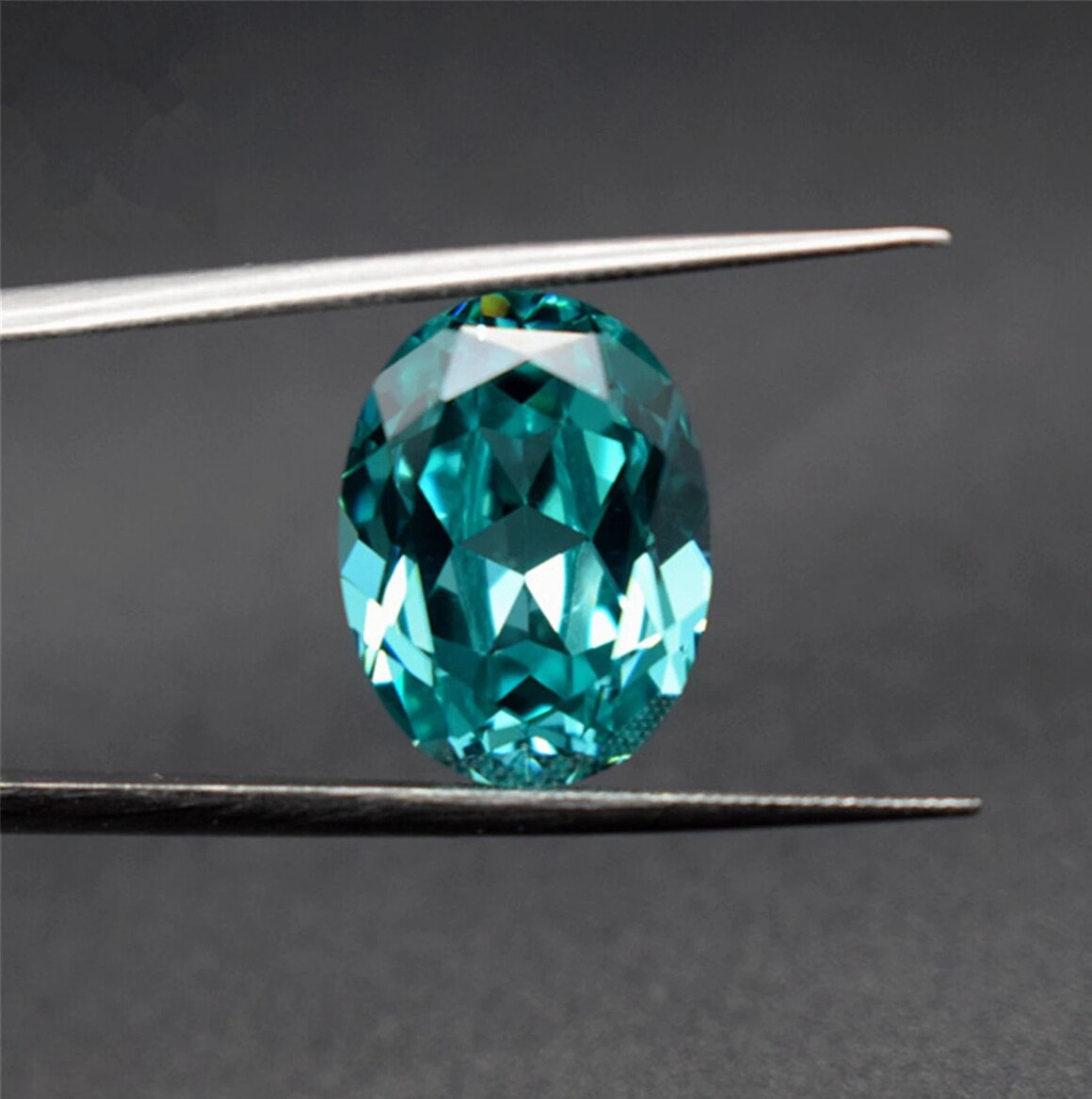

Paraíba Tourmaline

Paraíba Tourmaline stands out as a highly desirable investment gemstone. Known for its electric blue hue, Paraíba tourmaline is exceptionally rare and continues to appreciate. Its unique colour and limited supply drive strong demand from collectors and investors worldwide, making it a standout choice for 2025. The market consistently rewards those who acquire top-quality Paraíba tourmalines, as prices for these gems reflect their scarcity and beauty.

Key Market Trends and Influences

Several emerging trends shape the gemstone market. First, demand for coloured gemstones is increasing, driven by shifting fashion trends and celebrity endorsements. Consumers increasingly seek bespoke, unique jewellery and birthstones, driving up prices for rare stones.

Second, ethical sourcing and sustainability are now top priorities for buyers. Stones with transparent origins and responsible mining practices command higher premiums. Finally, technological advancements in jewellery design and certification are making it easier for investors to verify authenticity and value.

Benefits and Risks of Gemstone Investments

Tangible Assets with Unique Advantages

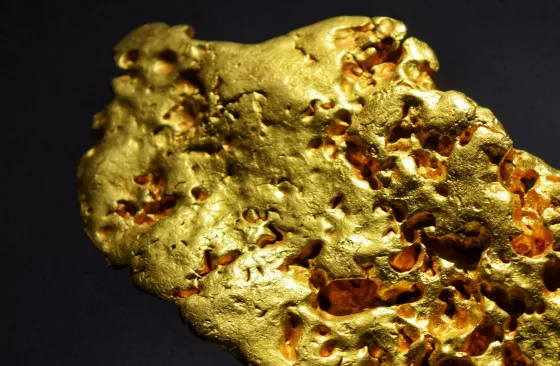

Gemstone investments present a compelling way for investors to diversify their portfolios and add tangible value. Unlike traditional assets such as gold or stocks, gemstones offer privacy, portability, and the pleasure of owning beautiful, portable treasures. Owners appreciate the aesthetic qualities of their gemstones daily, whether they are drawn to the rich purples of amethyst and tanzanite, the vibrant pinks of rhodochrosite and rose quartz, or the rare beauty of kunzite. This dual appeal, both as a financial asset and a personal collection, makes gemstones especially attractive to those seeking more than just monetary returns.

Hedge Against Inflation and Market Volatility

Gemstones also serve as a hedge against inflation and currency fluctuations. Their scarcity and enduring demand often result in steady appreciation over time, particularly for high-quality, certified stones from reputable sources. The privacy associated with gemstone ownership is another significant benefit, allowing assets to be discreetly stored and transferred without public scrutiny.

Understanding the Risks: Liquidity and Authentication

Investors must remain aware of the risks involved in gemstone investing. Market liquidity can be limited, especially for rare or high-value stones. Selling a significant gemstone may take months or even years, as finding the right buyer often requires patience and expert negotiation. Authentication is another critical concern; fraud and misrepresentation remain persistent challenges. To mitigate these risks, investors should always purchase certified stones and work with trusted, reputable dealers who provide clear documentation and transparent pricing.

Valuation, Storage, and Geopolitical Considerations

Valuation uncertainty is another factor to consider. Unlike standardised assets, gemstones require expert appraisal, and prices can fluctuate based on market trends, provenance, and gemological characteristics. Storage and insurance costs contribute to the overall investment, as collectors must safeguard their assets against theft, damage, or loss. Finally, geopolitical risks can impact the supply chain, particularly for stones sourced from politically unstable regions, which may affect both availability and pricing.

Making Informed Decisions

By understanding both the benefits and risks, investors can make informed choices and build a resilient, diversified gemstone portfolio that aligns with their financial goals and personal interests. Whether drawn to the rich hues of purple amethyst, the delicate beauty of pink tourmaline, or the rarity of kunzite, gemstone investing offers a unique blend of opportunity and enjoyment for those who approach it with knowledge and care.

How to Start with Gemstone Investments: Expert Tips

Start with Clear Investment Goals

Before purchasing your first gemstone, clearly define your investment objectives. Ask yourself whether you want a long-term store of value, a wearable asset, a legacy piece, or simply portfolio diversification. Your goals will shape your budget, the types of gemstones you consider, and your investment timeframe. Investing with intention ensures you make informed choices from the outset.

Choose Proven Gemstone Types

Focus on gemstones with established market demand and a strong track record of value retention. Rubies (especially from Burma and Mozambique), sapphires (notably from Kashmir and Sri Lanka), Colombian emeralds, and select stones like spinel, tanzanite, or alexandrite are proven performers. These varieties offer greater liquidity and are more likely to appreciate over time compared to exotic or less-known gems.

Insist on Certification from Reputable Labs

Never invest in a gemstone without certification from an internationally recognised laboratory such as GIA, SSEF, Gübelin, IGI, or HRD. Certification verifies that the gem is natural, discloses any treatments, and confirms details like size, colour, and origin. Certified stones command higher prices and are easier to sell, making certification non-negotiable for serious investors.

Work with Trusted and Knowledgeable Dealers

Select dealers with strong industry credentials, transparent pricing, and a reputation for integrity. Experienced dealers provide detailed documentation, access to a wide range of stones, and valuable market insights. Building a relationship with a trusted expert ensures you receive sound advice and gain access to rare, high-quality gemstones.

Prioritize Secure Storage and Insurance

Protect your investment by storing gemstones securely, ideally in individual soft pouches or containers within a safe or bank vault. Insure your collection against loss, theft, or damage, and keep up-to-date documentation, including photographs and certificates. Proper storage and insurance safeguard your assets, providing peace of mind.

Stay Informed and Build Industry Relationships

Continuously educate yourself about market trends, price movements, and emerging opportunities. Develop relationships with gemologists, appraisers, and fellow collectors to stay ahead of the curve. Regularly review auction results and industry reports to validate prices and identify new investment prospects.

Adopt a Long-Term Investment Mindset

Gemstone investing is not a short-term game. Plan to hold your assets for at least three to seven years, or longer, for optimal returns. The market for gemstones is less liquid than for stocks or gold, so patience is essential. By adopting a long-term perspective, you allow time for market appreciation and avoid the pitfalls of forced sales during periods of low liquidity.

By following these expert tips, you position yourself for success in the dynamic and rewarding world of gemstone investing.

The Future of Gemstone Investments: 2025 and Beyond

The global gemstone market is projected to grow robustly, with a compound annual growth rate (CAGR) of 6.6% expected from 2025 to 2035. High-net-worth individuals and collectors are driving demand, particularly for rare, coloured gemstones.

Emerging trends such as custom jewellery, ethical sourcing, and advanced certification will continue to shape the market. As supply tightens and demand rises, gemstone investments are poised to deliver both financial and aesthetic rewards for decades to come.

Conclusion: Should You Invest in Gemstones in 2025?

Gemstone investments offer a compelling combination of beauty, rarity, and long-term value. While risks exist, informed investors who prioritise certification, ethical sourcing, and market research can achieve significant returns. As the market evolves, staying ahead of trends and working with trusted experts will be key to success.

Ready to start your gemstone investment journey? Begin by researching, connecting with reputable dealers, and building a diversified collection of high-quality stones. The future of gemstone investments looks brighter than ever in 2025.

Frequently Asked Questions (FAQ)

Gemstones are increasingly considered a strong alternative investment in 2025. Their rarity, beauty, and ability to hedge against inflation make them attractive for portfolio diversification. However, success requires knowledge, patience, and careful selection of high-quality, certified stones.

Key risks include limited market liquidity, potential for fraud or misrepresentation, valuation uncertainty, storage and insurance costs, and geopolitical risks for stones sourced from unstable regions. Always buy certified stones from reputable dealers to mitigate these risks.

Experts recommend holding gemstones for at least three to seven years to maximise returns. The market for gemstones is less liquid than for stocks or gold, so patience is essential.

Yes, gemstones offer both financial appreciation and personal enjoyment. Their beauty makes them wearable assets, and their rarity ensures they remain valuable over time.

Ready to Start Your Gemstone Journey?

Don’t wait to discover the world of gemstones! Explore these essential reads right away.

Fascinated by this article and want to deepen your gemstone expertise? Dive into our comprehensive Gemstone Encyclopedia. Here, you’ll discover detailed information about hundreds of precious and semi-precious stones, including their properties and values.

For those interested in the rich cultural significance and fascinating stories behind these treasures, our History section offers captivating insights into how gemstones have shaped civilisations. Or perhaps you’d like to learn more about birthstones?

And if you’re considering gemstones as more than just beautiful adornments, visit our Precious Metal Investing guide. Here you will learn how these natural wonders can become valuable additions to your investment portfolio.